Articles

The newest put legislation derive from the fresh times whenever earnings is paid back (cash foundation), instead of whenever taxation debts is accrued to possess bookkeeping aim. Noncash earnings, along with item wages, is actually handled while the bucks wages if the material of one’s deal try a money commission. Noncash wages handled since the bucks earnings are at the mercy of personal shelter taxes, Medicare taxes, and you will federal income tax withholding.

Reporting Adjustments so you can Variations 941, Mode 943, or Function 944

- It’s important to focus on complement possibilities and build a calm atmosphere for you plus bridesmaids.

- Next i apply their places and you can costs on the averaged obligations regarding the date purchase i received your own places.

- With this instances, the player have to use 20 dumps, and you may win $ 20 over extent transferred.

- Sharon submitted a good 2025 Mode W-4 and you will appeared the package to have Solitary or Hitched submitting independently.

Having typical volatility, professionals is welcome a balanced shipment away from development, consolidating practical yet , repeated profits with periodic more critical perks. The overall game’s RTP from 92.97% means a theoretical get back following next a great average. Nonetheless, the fresh average volatility ensures a steady and you can fascinating game play experience, improving the over excitement of your own alien thrill.

Videos and you can tips to greatest control your monetary life

SlotoZilla is actually an independent site with free online casino game and you can analysis. Everything on the internet site features a purpose simply to servers and you can show folks. It’s the newest people’ personal debt to test your neighborhood laws prior to to play online. Away from amazing bulbs and you may charming online game, casinos act as a center private communications.

If the a prior season error are a nonadministrative error, you can also correct just the earnings and you may info at the mercy of Additional Medicare Taxation withholding. Have fun with Form 941-X, Form 943-X, or Setting 944-X and then make a correction when you find a blunder on the a previously registered Setting 941, Function 943, otherwise Function 944. There are also Mode 945-X and Function CT-1 X so you can statement modifications on the related output. Explore Function 843 when requesting a reimbursement otherwise abatement of reviewed focus otherwise penalties. Separate bookkeeping whenever dumps are not made or withheld taxation are not paid off. Willfully function willingly, knowingly, and you will purposefully.

- Right back spend, along with retroactive wage grows (yet not number repaid as the liquidated problems), is actually taxed while the typical earnings in the year repaid.

- You’re able use the File Publish Device to reply digitally in order to qualified Internal revenue service sees and you will characters from the safely posting needed data files on the web thanks to Irs.gov.

- The game continues on the storyline of a single’s race up against the alien intruders, however with an extended facts and a lot more varied mission standard.

- Go to Irs.gov/EmploymentEfile more resources for filing the a career taxation statements digitally.

Other than taking greatest output, Planet Moolah info will try to help you remind this feature since it is actually enjoyable and you will interesting at the same time. The backdrop reveals Saturn as well as feature organizations and other globes regarding the variety. The new reels is simply framed which have helpful tabs and you may you can even purchase keys so you can build display screen look like the fresh request blog post out of an excellent spaceship. Buy the better jackpot and direct the new prevent attack so you can conserve the planet. Bringing completely available to the challenge you to definitely lies to come, make sure you search through the over overview of Alien Physical violence. View scores depend on the new truthful views away from users and you will our very own party and therefore are possibly perhaps not influenced by Endless Gambling enterprise.

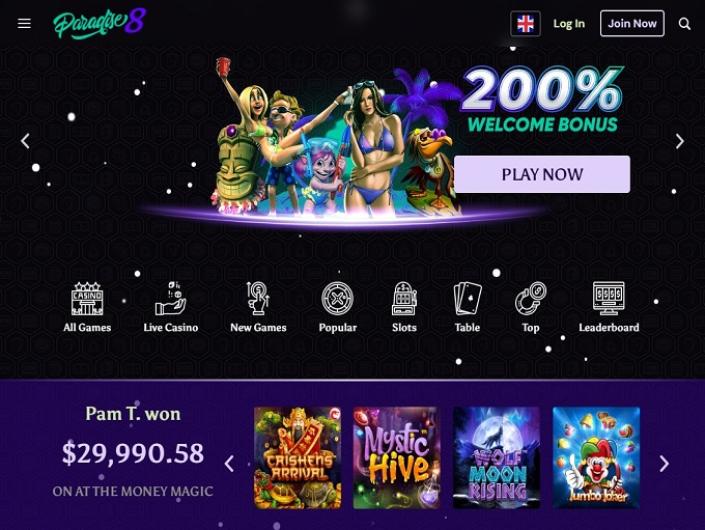

As well as ports, Casino Action Gambling establishment offers many different dinner dining table video game. All the better cellular casinos will give a https://happy-gambler.com/raw-casino/ comparable local casino video game that are offered with the pc competition. All of the casinos on the internet being offered play with best app so you can provide a great gaming feel. At some point the possibility are as a result of your, and you can and therefore local casino you like undoubtedly probably the most. The reason being cellular casinos is simply during the mercy of an identical criteria since the searching an internet-based casinos, and possess to keep highest amounts of protection since the a great status of its allow.

One can quickly be studied aback from the comical form from it Globe Moolah casino slot games. But really, this has been on purpose done this one to professionals are increasingly being gone to live in another dimensions. If you paid off much more from 12 months than just you borrowed from inside the tax, you can get cash return. Even if you don’t shell out income tax, you may still score a reimbursement for many who qualify for an excellent refundable credit. Check out Irs.gov/SocialMedia to see various social network systems the newest Irs spends to share the newest information regarding tax changes, ripoff notification, initiatives, things, and you will features.

You may also have to document advice productivity so you can statement certain kinds of payments produced within the season. Such as, you need to document Form 1099-NEC, Nonemployee Compensation, to report payments away from $600 or higher in order to individuals perhaps not managed since the staff (such as, separate contractors) to possess features did to suit your change or company. Generally, avoid using Forms 1099 to declaration wages or any other payment your paid back in order to group; report these types of to the Setting W-dos. See the Standard Tips for Variations W-2 and you can W-3 to own information about submitting Function W-dos and for factual statements about needed electronic filing.

Resolve a refund problem

Inform you because the a negative changes to your Function 941, line 8 (otherwise Function 943, line 10; otherwise Setting 944, line 6), the fresh social security and Medicare fees withheld on the unwell shell out by the a 3rd-team payer. Spice Co. are a month-to-month schedule depositor which have seasonal group. They paid back wages for each Saturday throughout the March but did not shell out any earnings through the April. Under the monthly put agenda, Spruce Co. need to deposit the newest joint income tax liabilities to the March paydays from the April 15.

To find out more, go to the SSA’s Company W-dos Processing Recommendations & Information page during the SSA.gov/workplace. If you walk out business, you must file a final return for the last one-fourth (a year ago to have Mode 943, Form 944, or Mode 945) where earnings (nonpayroll money to have Function 945) is actually repaid. For individuals who continue to spend wages or any other compensation to have episodes following cancellation of one’s organization, you should file output for those periods. Comprehend the Instructions to possess Function 941, Instructions to possess Function 943, Tips to possess Form 944, or Tips to possess Setting 945 to possess info on tips document a final go back. You must document Form 943 for each season beginning with the first season you spend $dos,500 or maybe more for farmwork or if you implement a farmworker which fits the newest $150 attempt informed me under Personal Security and you will Medicare Taxation, within the point 9. Don’t report these types of wages to the Form 941, Mode 944, or Setting 945.

The RTPpercent’s and jackpots may be the exact same, with some web based casinos even giving advantages to users just which choose to experiment through mobile rather than to try out for the the net as a result of desktop computer. Including, lawmakers on the Nyc and Indiana are continuously using laws who allow it to be on-line casino workers in their limits. In almost any state in which casinos on the internet become, citizens and you will folks have access to casino websites using their phones. All of the greatest casinos on the internet try from a surprisingly highest top quality. No matter the person you decided to game that have, you’ll find an extraordinary group of casino games from finest team. Mobile casinos try a hugely popular way for players to enjoy local casino gaming.